FIGURES IN PHILIPPINE PESOS, EXCEPT % AND SHS O/S

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

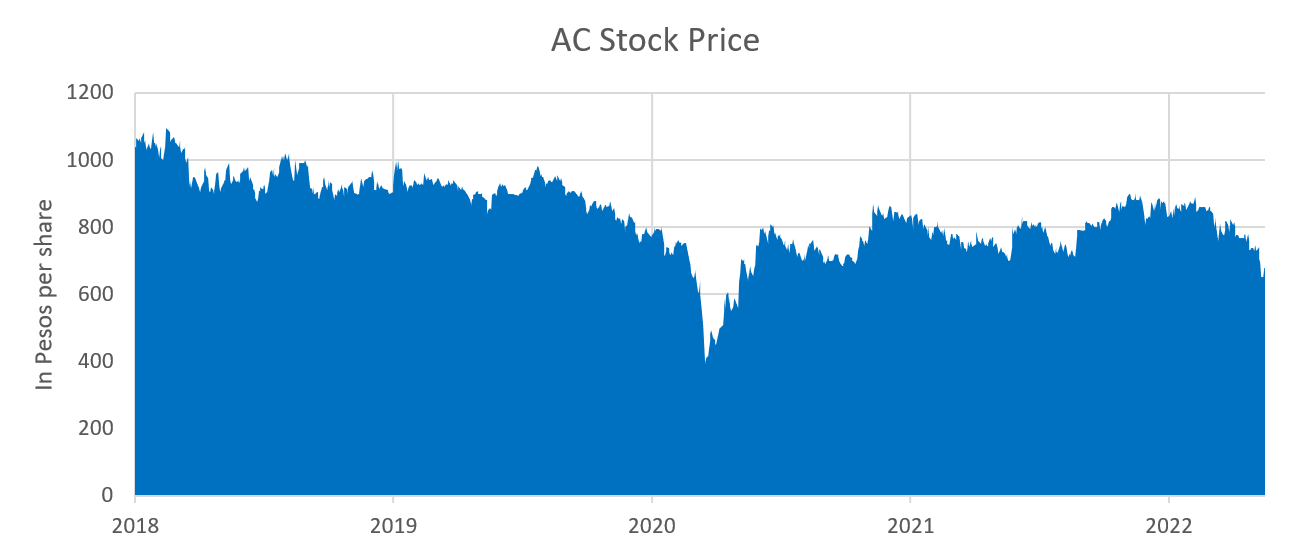

| Period-End Price | 831.00 | 827.00 | 785.50 | 900.00 | 1,015.00 | 730.50 | 756.00 | 694.00 | 518.00 |

| Period-High | 908.00 | 849.00 | 1,007.00 | 1,095.00 | 1,116.00 | 908.00 | 823.50 | 740.00 | 688.00 |

| Period-Low | 651.00 | 690.50 | 738.00 | 867.50 | 722.50 | 600.00 | 692.50 | 510.00 | 500.00 |

| Common Shares Outstanding (millions) | 620 | 627 | 627 | 631 | 621 | 621 | 620 | 619 | 599 |

| Free Float | 51.23% | 51.9% | 49% | 44% | 40% | 40% | 40% | 40% | 38% |

| Market Capitalization (billions) | 515 | 519 | 492 | 568 | 631 | 453 | 468 | 430 | 311 |

| Ayala Group mkt cap to PSEi | 27% | 22% | 20% | 21% | 20% | 19% | 20% | 19% | 20% |

| Ayala Corp mkt cap to PSEi | 5% | 6% | 5% | 6% | 6% | 6% | 6% | 5% | 5% |

| Basic EPS | 42 | 25 | 54 | 49 | 47 | 40 | 34 | 30 | 21 |

| Book Value per share | 545 | 529 | 513 | 449 | 375 | 334 | 295 | 262 | 231 |

CAPITAL MEASURES

Listing at the Philippine Stock Exchange November 8, 1976

Declassification of Class A and B shares November 5, 1997

50:1 Reverse Stock Split May 30, 2005