We remain committed to ensuring that we give value to our stakeholders through constant corporate governance, and management of our environmental and social impacts. Our approach is aimed at continuous improvement for our people and the communities we serve. Our business leadership for almost two centuries is driven by our rigor and discipline, keeping us focused on our vision to be the most relevant, innovative, and enduring business group in the Philippines.

Strategic Business Development123

At Ayala, we constantly look for new investment areas, identify opportunities, and assess emerging markets and economic trends. This process includes a thorough analysis of the performance of a business and weighing this against competition, the business landscape, and our approved budget plan. This process determines capital allocation decisions.

All investment proposals that progress beyond the business unit or the Corporate Strategy group and the Finance group are presented to the Investment Committee composed of Ayala’s key senior officers and other senior group executives invited to provide insight. The Investment Committee then reviews the business plan and the strategy for execution. A thorough discussion on risks is carried out and responsible persons are identified to execute the business plan. If the proposed investment is approved, it is then endorsed to the Finance Committee of the Board.

Capital Allocation123

In practice, investment decisions are weighed upon whether they can deliver significant value over time. We follow a rigorous process that evaluates opportunities and tests for business and financial viability. Once capital is approved and deployed, management designates a responsible management team for implementation. Business performance is reviewed on a regular basis, and our gating process involves many groups within the company, including Corporate Strategy and Development, Finance, the Investment Committee, the Board’s Finance Committee, and the Board of Directors.

Portfolio Management13

The Investment Committee and the Board’s Finance Committee review the performance of each business unit through a portfolio strategy cycle throughout the year. This starts with a Group CEO session to align on our outlook, followed by a portfolio review to study our existing assets set against the current macroeconomic backdrop, regular deep dives on specific business units, and an assessment of performance against annual targets. This process provides Investment Committee a platform to determine whether to increase or hold capital allocation or realize value from certain investments. Beyond equity capital, Ayala provides critical support to businesses where necessary, including deploying key talents and corporate infrastructure for sustainability, audit, risk management, legal, strategy, and corporate finance functions.

Balance Sheet Management3

The continued prudence and active management of our balance sheet helped cushion the impact of the ongoing pandemic especially that it has become long and drawn out. With the coordinated effort of government and private organizations on the vaccination front, we continue to hope for a strong recovery moving forward and have tailored our balance sheet and financial management strategy to ride on this growth momentum. Our strategy involves the diversification of our funding sources in the loan and capital markets and a sharper focus on liability and financial risk management. These initiatives are in anticipation of broad-based recovery and rising interest rates.

We continue to ensure that our balance sheet remains strong with significant debt capacity and a well–spread-out maturity profile that gives us the flexibility to fund growth opportunities. This is augmented by optimal foreign exchange and interest rate exposure management and diversified funding sources to manage our liquidity requirements. Dividends from Ayala’s portfolio of core businesses also augments our capacity to service operating expenses, interest obligations, and dividends obligations. Our diversified portfolio of businesses also play a key role in mitigating portfolio risk.

Ayala’s loan to value ratio, which compares our net debt to the market value of our investments, is a good measure of our relative indebtedness and our capacity to take on or service our obligations. Tracking this ratio daily helps the Investment Committee in deciding on whether to recycle capital by selling assets to prune our debt levels or take on additional debt to buy undervalued assets during period of uncertainties. The value realization initiatives Ayala executed in 2021 helped fund new investments including our buyback of AC and ALI shares. Our pipeline of value realization initiatives will further strengthen our balance sheet and financial positions.

At the end of 2021, our loan to value ratio decreased to 6.7 percent from 9.2 percent in 2020. The improvement can be attributed to the significant increase of the market values of our assets.

We are comfortable with our loan to value ratio, which indicates that for every ₱6.70 of debt we carry, we have ₱100 of assets behind it. The ratio does not include the impact of our fixed-for-life perpetual bonds as these are perpetual securities and do not have to be repaid. Gross debt was at ₱135.2 billion, while our net debt ended at ₱115 billion. We continue to maintain a high cash position of ₱20.2 billion which not only gives us comfort during challenging times, but also enables us to act quickly on growth opportunities and fund our capital expenditure requirements. At the parent level, net debt to equity ratio stood at 0.90 to 1.

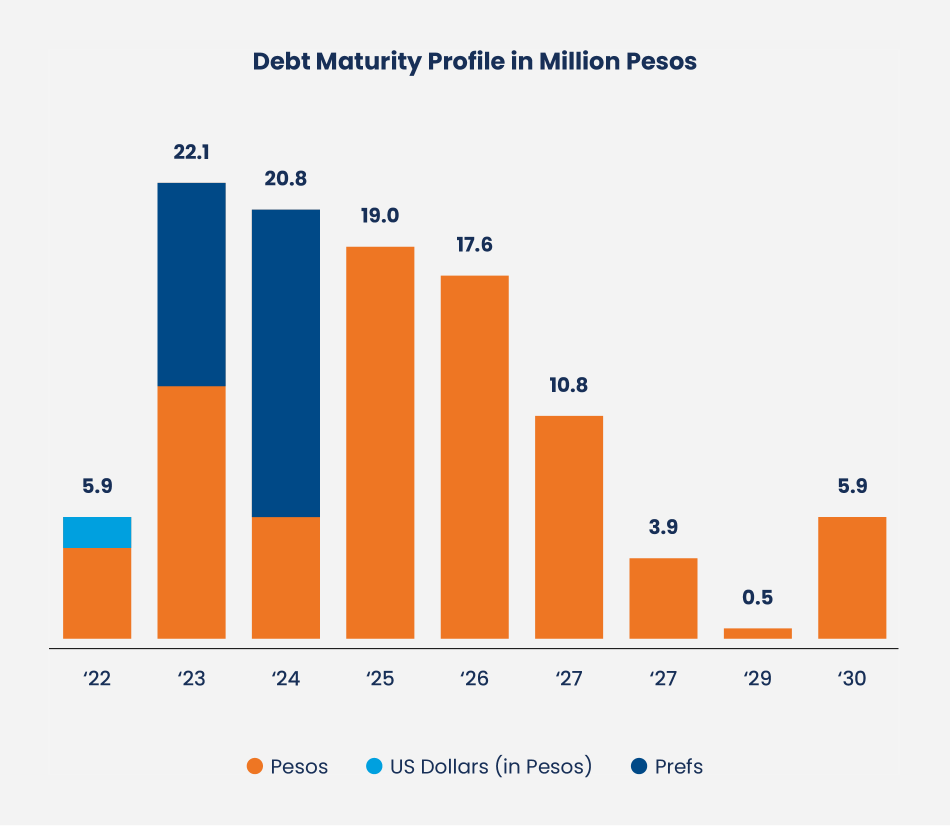

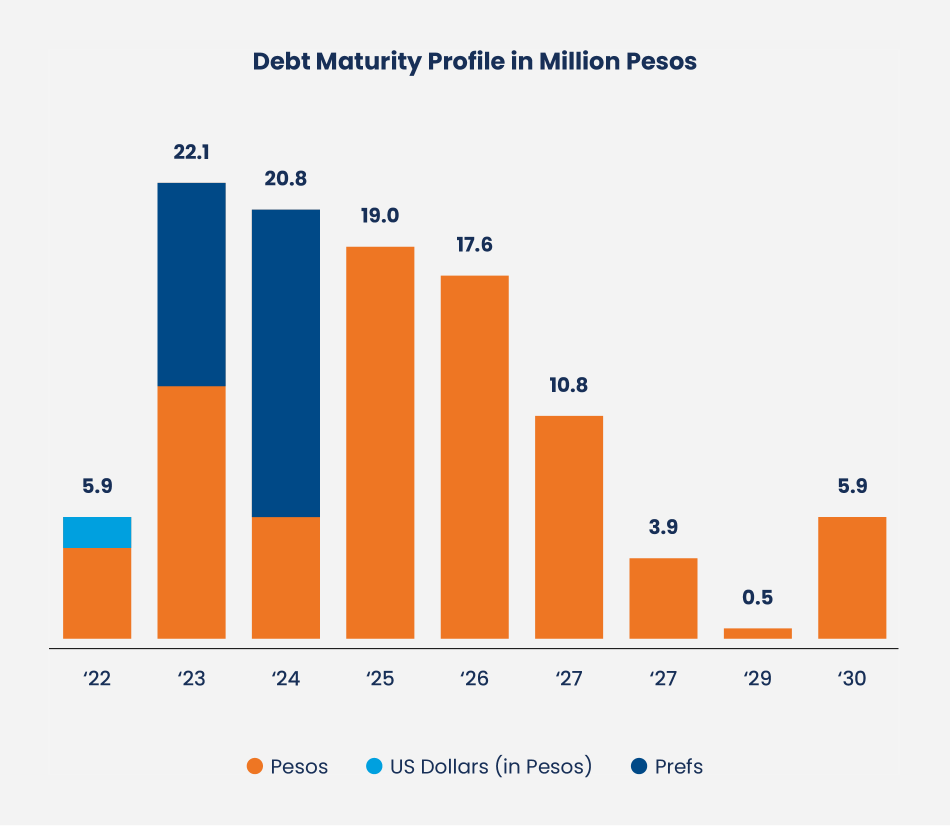

At the end of 2021, our blended cost of borrowings improved to 4.3 percent per annum from 4.5 percent per annum in the previous year. The refinancing of some of our higher interest loans and bonds optimized our financing costs in a rising interest rate environment. We actively managed our obligations and ensured that we mitigate liquidity, foreign exchange, and interest rate risks. In line with this is a quarterly assessment of our potential risk exposures where we calculate the volatility impact on interest rates and foreign exchange. We also adopted hedge accounting to support our currency risk management initiatives. We ensure that our debt maturities are well spread out and in compliance with our internal policy of not having maturities exceeding 20 percent of total debt annually. This ensures that an external event that might affect refinancing in any given year does not cause substantial liquidity exposures.

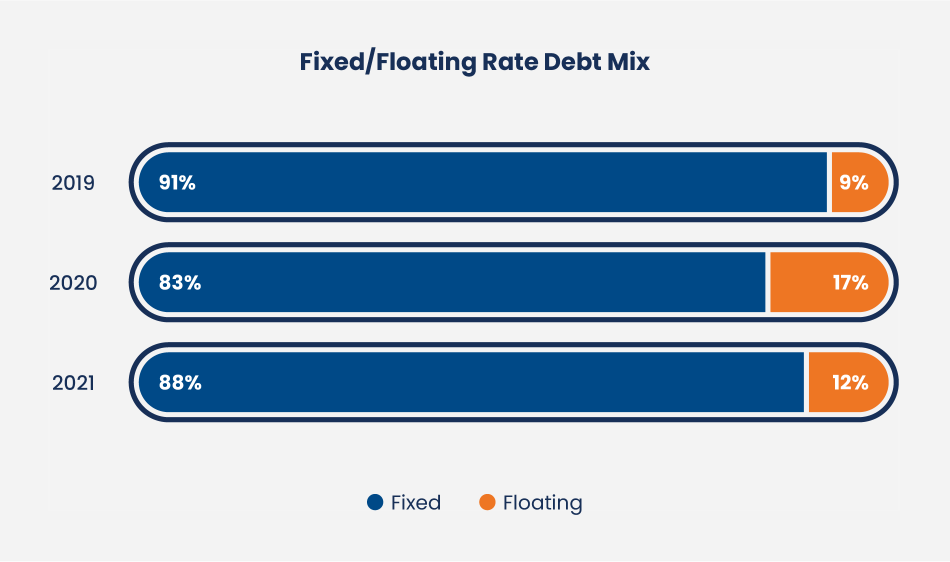

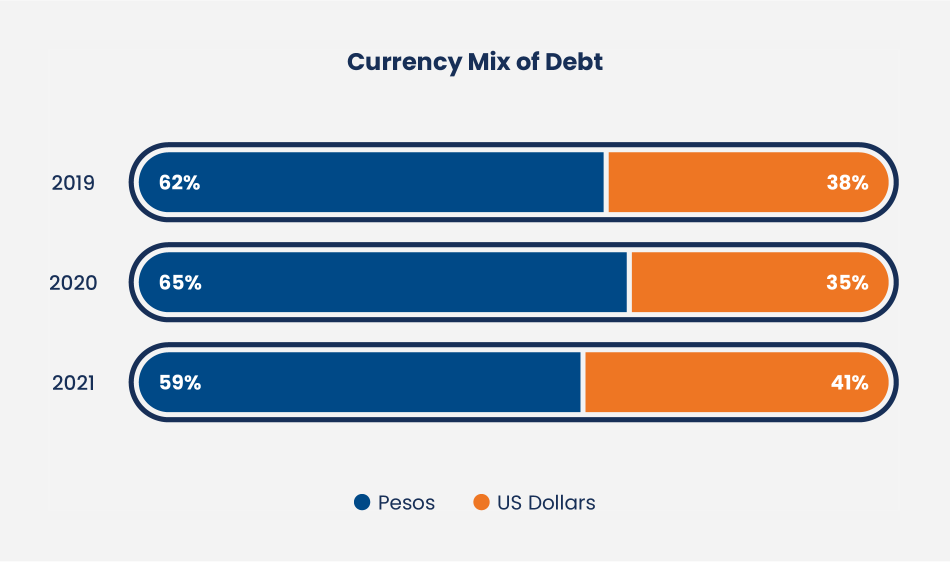

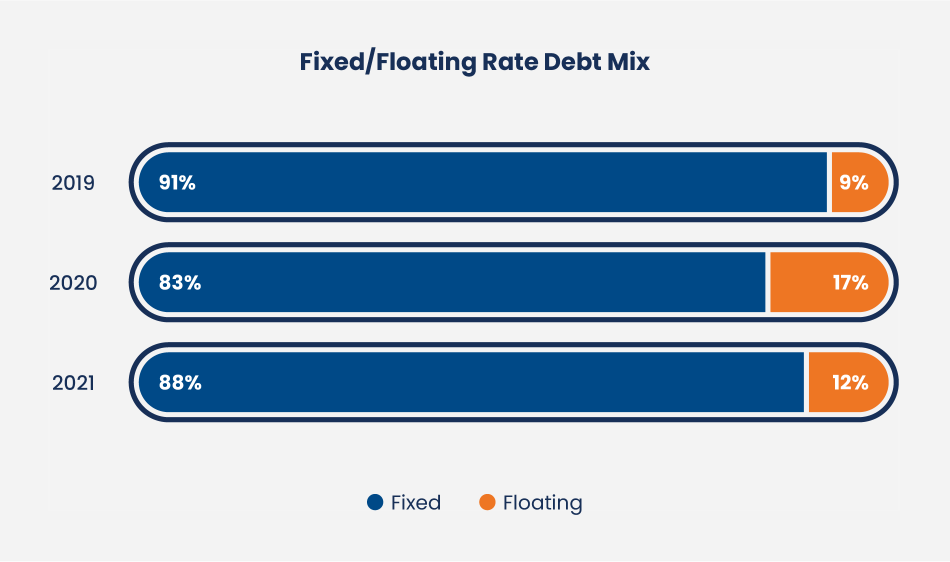

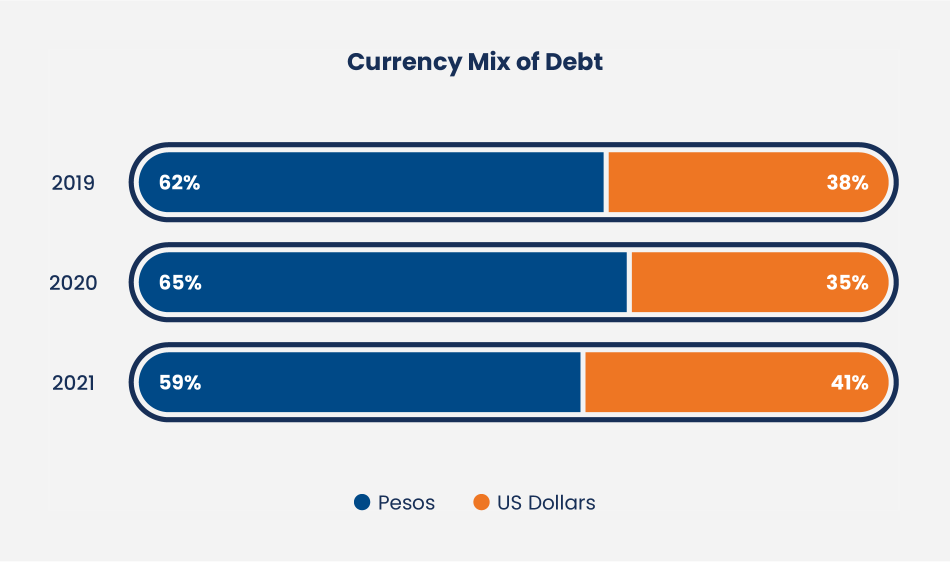

We maintain a minimum ratio of fixed rate loans to floating rate loans to ensure that our cost of capital carries a similar characteristic with our long-term investments. Our fixed to floating rate mix of 87.6/12.4 reflects our strategy of capitalizing on lower interest rates and puts Ayala in a favorable position in a rising rate environment. This is a conscientious move on our part, anticipating a change in monetary policy and the gradual transition from Libor which may affect our floating rate obligations. Philippine Peso obligations are 58.9 percent of our total obligations and our US Dollar denominated obligations are more than offset by US Dollar cash and long-term foreign currency investments. Hedging is done if non-peso debt is used to fund peso investments. For prudence, foreign currency denominated debt is used to finance foreign-currency denominated investments.

Percentage of Total Parent Debt including Debt Guaranteed by Parent

Our sound financial management practices allow us flexibility in our investment decisions. Our strategy with regards to financing is to raise debt opportunistically in the public markets and rely on strong and transparent banking relationships in the loan markets.

Lastly, our strong credit is shown in our capital raising activities and supported by continued wide access to bank loans even during the pandemic. In May 2021, we successfully raised ₱10.0 billion in fixed rate bonds, marking the first tranche of our ₱30.0 Billion Debt Securities Program. Ayala successfully priced the issuance at the tightest side of the range given high investor interest. In September, we tapped the international bond markets with the issuance of US$400.0 million fixed- for-life senior perpetual securities priced at coupon rate of 3.9 percent. The offering was met strongly by the market, being 4.4 times oversubscribed despite being the lowest yielding unrated perpetual fixed-for- life notes ever in Asia. Finally, in November, we signed the agreement for a US$100 million Social Bond and launched the first social bond for AC Health through a private placement that helped broaden our funding sources in the capital markets. Our diversified financing sources allows access to a unique and dependable funding base in times of market stress and offers the flexibility to take advantage of the expected Philippine recovery. We maintain ample cash and maintain high level of credit facilities from both local and foreign banks to ensure we have available sources of funds to finance new investment opportunities.

Share Price Performance

2021 continued to be a challenging year for the Philippines as the COVID-19 pandemic widened its spread. Quarantine measures throughout the year fluctuated with the rise and fall of daily infections, affecting the flow of mobility, business operations, and social activity. Despite the volatility, enterprises and individuals alike grew more accustomed to such circumstances, resulting in a generally more stable and predictable economic environment over the year. This was helped in large part by an improvement in vaccination rates when the government’s inoculation program kicked off in March. By the end of the year, over half of the Philippine population was vaccinated. This resulted in better business confidence and was reflected in GDP growth which hit 5.6 percent for the year, reversing from a 9.6 percent decline in 2020.

Throughout the year, Ayala’s share price and Philippine stock market moved with the ebb and flow of daily COVID infections, reaching twin troughs in May and August when surges were worst, and peaks early and late in the year when cases were at their lowest.

From the start of the year all the way through May, Ayala saw its share price steadily drop as infections post-holidays climbed steadily. By March when the increase in infections grew more evident, Metro Manila was placed under the stricter enhanced community quarantine, two steps higher from the general community quarantine it was under. This further dragged on Ayala’s share price, causing it to dip below the ₱700/share mark at its lowest point. Although the government’s inoculation program begun during this same period, vaccine procurement was inadequate and the focus was instead put on the slow pace of orders coming in, thus impacting sentiment.

Come May, vaccinations in the country finally ramped up while the daily infection count began to subside. This led to a sharp but short-lived recovery in both Ayala and the market that spanned for about two months. By then, share price had reverted to where it was during the start of the year. Over the course of July though, the spread of COVID infections steepened once again, this time multiplying even faster than it did in May as the Delta variant made its way through the country. As a result, Ayala’s price hit its third quarter trough in August at ₱707/share. By the end of the month, the same events that resulted a recovery late in May—improved vaccination rates and, eventually, fewer daily case counts—instigated another rally in the market. This time, the upturn spanned up until November with Ayala reaching as high as ₱908/share. Throughout this period, Ayala’s share price was able to stay above its pre- COVID levels. While the Omicron variant put a halt to this climb with resulting infections even worse than that of the Delta variant’s, businesses and individuals were far more prepared to deal with the Omicron surge. This resulted in significantly improved responses from the government and companies, and a relatively muted impact on consumer confidence.

Despite the volatility faced throughout the year, the result was flat performances for the Philippine Stock Exchange Index and Ayala, both recording just a 0.2 percent and 0.4 percent gain throughout 2021, respectively. After ending 2020 at ₱827/share, Ayala finished at ₱831/share in 2021.

Dividends

Ayala’s policy is to provide a regular fixed semi-annual cash dividend to common shares. For voting preferred shares, the dividend rate is 5.77 percent per annum. For non-voting Preferred B Series 1 and Series 2 shares, the dividends are given at 5.25 percent and 4.82 percent per annum, respectively. It is the company’s policy to treat all shareholders equally, ensuring payment of dividends in an equitable and timely manner—within 30 days after being declared and finally cleared.

In 2021, we declared total dividends per common share of ₱6.92, at par with the dividends distributed last year. We understand that our shareholders view our dividends as a regular source of both income and capital returns and strive to maintain consistent distributions from year to year. Moving forward, we will continue to revisit potential sustainable adjustments in the regular dividend rate, with the continued capacity to make new or additional investments as the primary consideration.

Our financial strategy helps us to remain sustainable and resilient, ensuring that we maintain relevance even in turbulent business and social climates.