Key Metrics

Stock Information > Key Metrics

FIGURES IN PHILIPPINE PESOS, EXCEPT % AND SHS O/S

|

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

| Period-End Price |

831.00 |

827.00 |

785.50 |

900.00 |

1,015.00 |

730.50 |

756.00 |

694.00 |

518.00 |

| Period-High |

908.00 |

849.00 |

1,007.00 |

1,095.00 |

1,116.00 |

908.00 |

823.50 |

740.00 |

688.00 |

| Period-Low |

651.00 |

690.50 |

738.00 |

867.50 |

722.50 |

600.00 |

692.50 |

510.00 |

500.00 |

| Common Shares Outstanding (millions) |

620 |

627 |

627 |

631 |

621 |

621 |

620 |

619 |

599 |

| Free Float |

51.23% |

51.9% |

49% |

44% |

40% |

40% |

40% |

40% |

38% |

| Market Capitalization (billions) |

515 |

519 |

492 |

568 |

631 |

453 |

468 |

430 |

311 |

| Ayala Group mkt cap to PSEi |

27% |

22% |

20% |

21% |

20% |

19% |

20% |

19% |

20% |

| Ayala Corp mkt cap to PSEi |

5% |

6% |

5% |

6% |

6% |

6% |

6% |

5% |

5% |

| Basic EPS |

42 |

25 |

54 |

49 |

47 |

40 |

34 |

30 |

21 |

| Book Value per share |

545 |

529 |

513 |

449 |

375 |

334 |

295 |

262 |

231 |

CAPITAL MEASURES

Listing at the Philippine Stock Exchange November 8, 1976

Declassification of Class A and B shares November 5, 1997

50:1 Reverse Stock Split May 30, 2005

Ownership Structure

Stock Information > Ownership Structure

Foreign Ownership

As of June 30, 2022 |

| Number of Shareholders |

6,336 |

| Percentage Holding 1 to 1,000 Shares |

84.97% |

| Foreign Ownership (all outstanding shares) |

20.51% |

| Voting Interest of Mitsubishi Corporation |

6.99% |

| Free Float Level |

51.22% |

Top 20 Shareholders

As of September 30, 2021 |

NO. OF

COMMON

SHARES |

% OWNED

(OF COMMON

SHARES) |

| 1. MERMAC INC |

296,625,706 |

47.87% |

| 2. PCD NOMINEE CORPORATION (NON-FILIPINO) |

140,628,196 |

22.69% |

| 3. PCD NOMINEE CORPORATION (FILIPINO) |

121,575,944 |

19.62% |

| 4. MITSUBISHI CORPORATION |

37,771,896 |

6.10% |

| 5. SHOEMART INC. |

7,529,203 |

1.21% |

| 6. SYSMART CORPORATION |

1,500,912 |

0.24% |

| 7. ESOWN ADMINISTRATOR 2020 |

1,455,430 |

0.23% |

| 8. SM INVESTMENTS CORPORATION |

1,448,502 |

0.23% |

| 9.PHIL. REMNANTS CO., INC. |

823,046 |

0.13% |

| 10. ESOWN ADMINISTRATOR 2021 |

558,849 |

0.09% |

| 11. ESOWN ADMINISTRATOR 2019 |

512,962 |

0.08% |

| 12.ESOWN ADMINISTRATOR 2018 |

482,414 |

0.08% |

| 13. ESOWN ADMINISTRATOR 2016 |

471,061 |

0.08% |

| 14. ESOWN ADMINISTRATOR 2017 |

421,609 |

0.07% |

| 15.ESOWN ADMINISTRATOR 2015 |

361,777 |

0.06% |

| 16. MITSUBISHI LOGISTICS CORP. |

360,512 |

0.06% |

| 17.ESOWN ADMINISTRATOR 2012 |

232,222 |

0.04% |

| 18.ESOWN ADMINISTRATOR 2014 |

219,466 |

0.04% |

| 19.TELENGTAN BROTHERS & SONS, INC. |

136,857 |

0.02% |

| 20.LUCIO YAN |

127,996 |

0.02% |

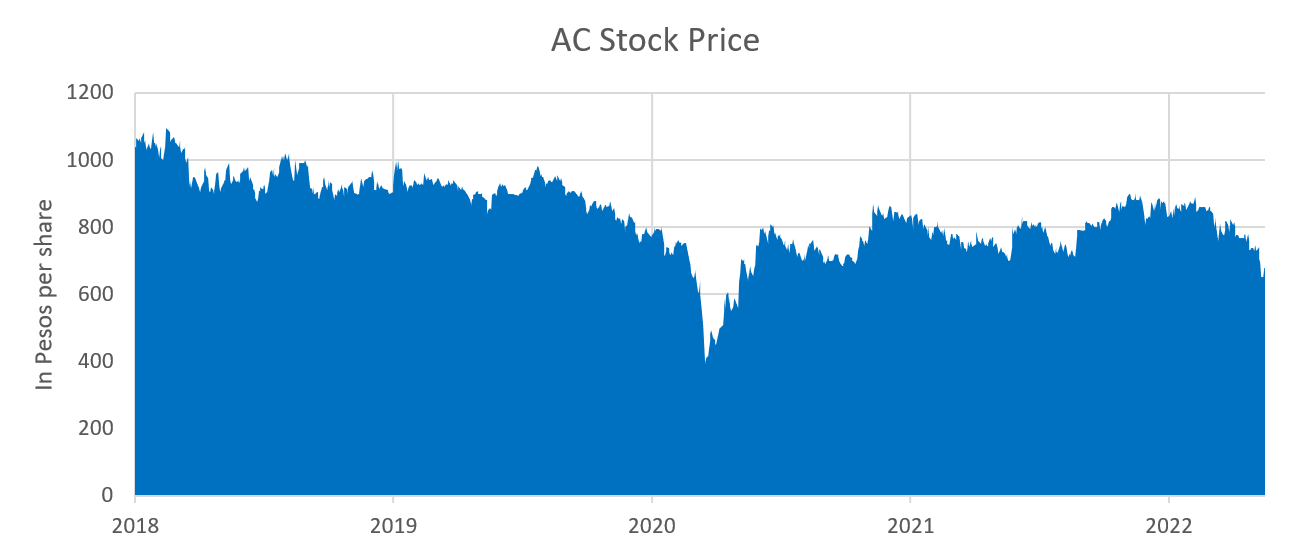

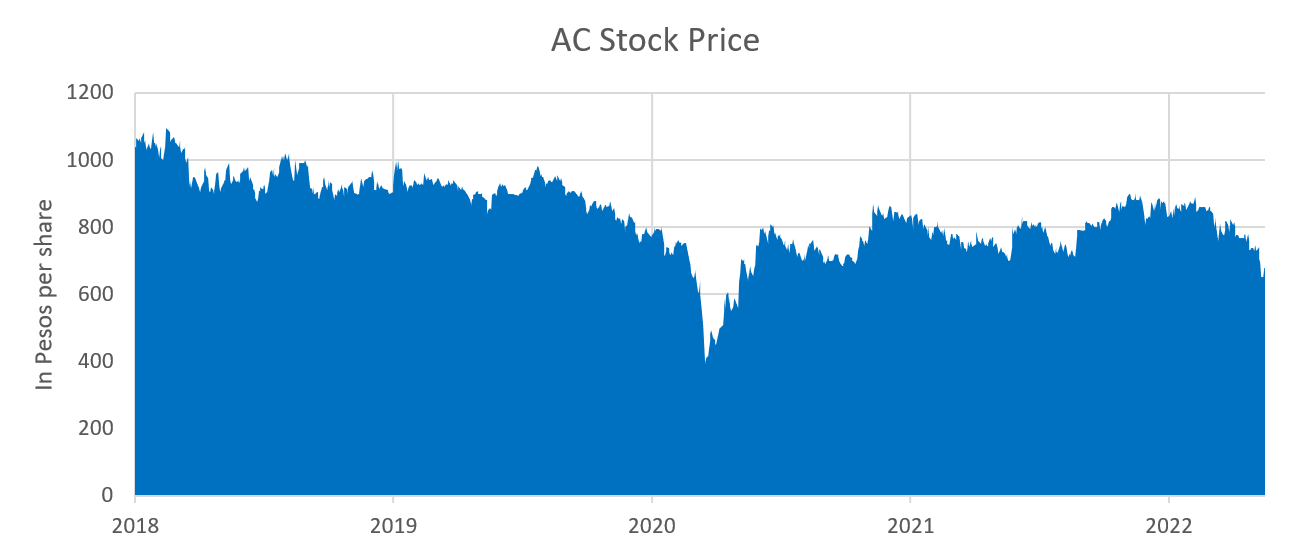

Stock Price History

Stock Information > Stock Price History

Ayala Corporation (Bloomberg AC:PM; Reuters AC:PS) listed in the Philippine Stock Exchange in 1976. From 2018 to 2021, Ayala’s stock price declined by 18.1% to ₱831.0 apiece as the effects of the global pandemic impacted the Philippine economy and the strength of the market. However, since the trough in March 2020, the health situation in the country improved, materializing as well in the rebound in Ayala’s share price. Its market capitalization ending at ₱515 billion in 2021. Ayala as of end-2021 accounted for 5% of the market capitalization of the PSE Composite Index.

Analyst Coverage

Stock Information > Analyst Coverage

Independent analysts of local and international brokerage houses follow Ayala’s stock and financial performance. The list below includes analysts known to cover the company on a regular basis and may change as firms adjust their areas of coverage.

Please note that this list is provided for information only and is not intended for trading purposes or advice. Any opinions, forecasts, estimates, projections or predictions regarding Ayala’s performance made by these analysts are theirs alone and do not represent the opinions forecasts, estimates, projections, or predictions of Ayala or its management. In addition, Ayala does not imply its endorsement of or concurrence with such reports, conclusions or recommendations.

COMPANY

|

ANALYST

|

EMAIL ADDRESS

|

| CLSA Philippines |

Alfred Dy |

alfred.dy@clsa.com |

| COL Financial Group |

Richard Lañeda |

richard.laneda@colfinancial.com |

| Credit Suisse |

Hazel Tanedo |

hazel.tanedo@credit-suisse.com |

| Goldman Sachs |

Douglas Eu |

Douglas.Eu@gs.com |

| JP Morgan Securities |

Jeanette Yutan |

danielandrew.o.tan@jpmorgan.com |

| Macquarie Capital Securities |

Gilbert Lopez |

Gilbert.Lopez@macquarie.com |

| Maybank ATR Kim Eng Securities Inc. |

Jacqui De Jesus |

jacquiannekelly.dejesus@maybank-atrke.com |

| Philippine Equity Partners |

Jojo Gonzales |

jojo.gonzales@pep.com.ph |

| Regis Partners |

Gio Dela Rosa |

gio.delarosa@regis.ph |

| UBS Securities |

RJ Aguirre |

rj.aguirre@ubs.com |

|

|

|

|

|

|

|

|

|

|

|

|